See my previous posts on IRA price negotiation on drug selection (Part 1) and manufacturer data submission (Part 2).

Today we will talk about the negotiation process and how CMS will set the maximum fair price (MFP)

How will CMS price across dosages?

“CMS will base the single price on the cost of the selected

drug per 30-day equivalent supply (rather than per unit—such as tablet,

capsule, injection—or per volume or weight-based metric), weighted across

dosage forms and strengths.”

Is there a maximum value or “ceiling” for the maximum

fair price (MFP) that CMS will offer?

The maximum MFP amount will be no higher than:

- An amount equal to the sum of the plan-specific

enrollment weighted amounts - The lower of: the average non-FAMP in 2021

increased by inflation (CPI-U) or the average non-FAMP price in February 2025

CMS will aggregate the 60 amounts determined for each NDC-11 for the selected drug to calculate a single amount – separately for each methodology – across dosage forms, strengths, and package sizes of the selected drug. These amounts can then be directly compared, and the ceiling for the single MFP of the selected drug (including all dosage forms and strengths) will be the lower amount.

Sample packages, NDCs from secondary manufacturers, NDCs

with no quantity dispensed or NDCs with gross covered prescription drug costs of

$0 will not be included in the MFP calculation.

Can some claims be excluded from the MFP refund?

Once the MFP price is determined, there are some cases where

a manufacturer would not have to pay the MFP refund. These include:

“…[justification] codes for the drug being prospectively purchased at or below the MFP, the manufacturer and dispensing entity having a separately negotiated refund amount distinct from the Standard Default Refund Amount, and the claim being excluded from MFP refunds under section 1193(d)(1) of the Act”

CMS has to justify the MFP to manufacturers. How will it do this?

The CMS justification will follow a 4-step process:

- Identification of therapeutic alternative(s), if any, for the selected drug. This includes FDA-approved drugs for the relevant indication and off-label use if included in nationally recognized, evidence-based guidelines and in a CMS-recognized compendia. CMS will begin by identifying therapeutic alternatives within the same pharmacologic class as the selected drug based on properties such as chemical class, therapeutic class, or mechanism of action, and then also consider therapeutic alternatives in different pharmacologic classes based on CMS’ review of relevant data (see question below).

- Measure the price of the therapeutic alternatives. For Part D drugs, this is total gross covered drug cost (TGCDC) net of DIR and CGDP payments and/or the Average Sales Price (ASP) for Part B drugs (or prior year MFP if applicable)

- Determine if drug has unique benefit. Evaluate whether the selected drug—relative to therapeutic alternatives—addresses an unmet need, has a beneficial impact on IRA specific populations, and the extent to which the selected drug represents a therapeutic advance compared to therapeutic alternative(s)

- Further adjustment of preliminary price. These adjustments will be based on manufacturer submitted data including: (1) R&D costs and R&D costs recouped, (2) current unit costs of production and distribution; (3) prior Federal financial support for novel therapeutic discovery and development; (4) pending and approved patent applications or exclusivities; and (5) market data and revenue and sales volume data for the drug in the US., and (6) optional manufacturer submitted data.

What data does CMS use to determine therapeutic alternatives?

“…CMS will use data submitted by the Primary Manufacturer and the public, FDA-approved indications, drug classification systems commonly used in the public and commercial sector for formulary development, CMS-recognized Part D compendia, widely accepted clinical guidelines, the CMS led literature review, drug or drug class reviews, and peer-reviewed studies.”

How could CMS set the initial price offer?

The primary way CMS will set it’s initial price offer for

2027 is based on the net price of therapeutic alternatives.

However…

If the selected drug has no therapeutic alternative, if the prices of all therapeutic alternatives identified are above the statutory ceiling for the MFP…or if there is a single therapeutic alternative for the selected drug and its price is above the statutory ceiling for the MFP, then CMS will determine the starting point for the initial offer based on the FSS or…“Big Four price”…whichever is lower. If the FSS and Big Four prices are above the statutory ceiling, then CMS will use the statutory ceiling as the starting point for the initial offer.

Why did CMS choose to set it’s initial price based on the

price of therapeutic alternatives?

Note that CMS did consider a variety of options for setting

the initial price offer including net prices, unit cost of production/distribution,

domestic references price to the Federal Supply Schedule (FSS) price, a “fair

profit” price based on whether R&D costs have been recouped and margin on

unit cost of production and distribution, but settled on the net price of

therapeutic alternatives.

However, it argues that the net price of therapeutic alternatives—despite

limitations—is a preferred option:

“In taking this approach, CMS acknowledges that the therapeutic alternative(s) for a selected drug may not be priced to reflect its clinical benefit, however, using Net Part D Plan Payment and Beneficiary Liability, ASPs, or MFPs of therapeutic alternatives enables CMS to start developing the initial offer within the context of the cost and clinical benefit of one or more drugs that treat the same disease or condition. By using the price(s) of the selected drug’s therapeutic alternative(s), CMS will be able to focus the initial offer on section 1194(e)(2) factors by adjusting this starting point relative to whether the selected drug offers more, less, or similar benefit compared to its therapeutic alternative(s).”

What factors will impact CMS’s decision to adjust its

initial offer?

Some considerations include:

- Clinical benefit conferred by the selected drug

compared to its therapeutic alternative(s), - Impact on patient-reported outcomes and patient

experience - Impact on caregivers

- Usage patterns of the selected drug versus its

therapeutic alternative(s) - Feedback from consultations with clinicians,

patients or patient organizations, academic experts, and/or the FDA - Impact on CMS special populations (individuals

with disabilities, the elderly, individuals who are terminally ill, children,

and other Medicare beneficiaries) - Whether or not the treatment meets an unmet

medical need

Key relevant information that will be considered include: “…peer-reviewed

research, expert reports or whitepapers, clinician expertise, real-world

evidence, and patient experience.” Key

outcomes of interest to be considered include a variety of outcomes, including

patient-centered outcomes, and patient experience.

Although CMS notes that it will not use cost-effectiveness

analysis based on QALYs, it has not ruled on whether it can use other

approaches such as equal value of life years gained (evLYG), health years in

total (HYT) or generalized and risk-adjusted QALYs (GRA-QALYs).

These factors will impact the price through a qualitative decision

process.

Will caregiver experience impact CMS decisions?

Yes. The

guidance says that “CMS may also consider the caregiver perspective to the

extent that it reflects directly upon the experience or relevant outcomes of

the patient taking the selected drug.”

Does CMS consider cost when evaluating if a treatment is

a therapeutic advance?

Yes.

“CMS will determine the extent to which a selected drug represents a therapeutic advance as compared to its therapeutic alternative(s) by examining improvements in outcomes compared to its therapeutic alternative(s) (e.g., selected drug is curative versus a therapeutic alternative that delays progression) and will consider the costs of such therapeutic alternative(s). CMS may consider a selected drug to represent a therapeutic advance if evidence indicates that the selected drug represents a substantial improvement in outcomes compared to the selected drug’s therapeutic alternative(s) for an indication(s).”

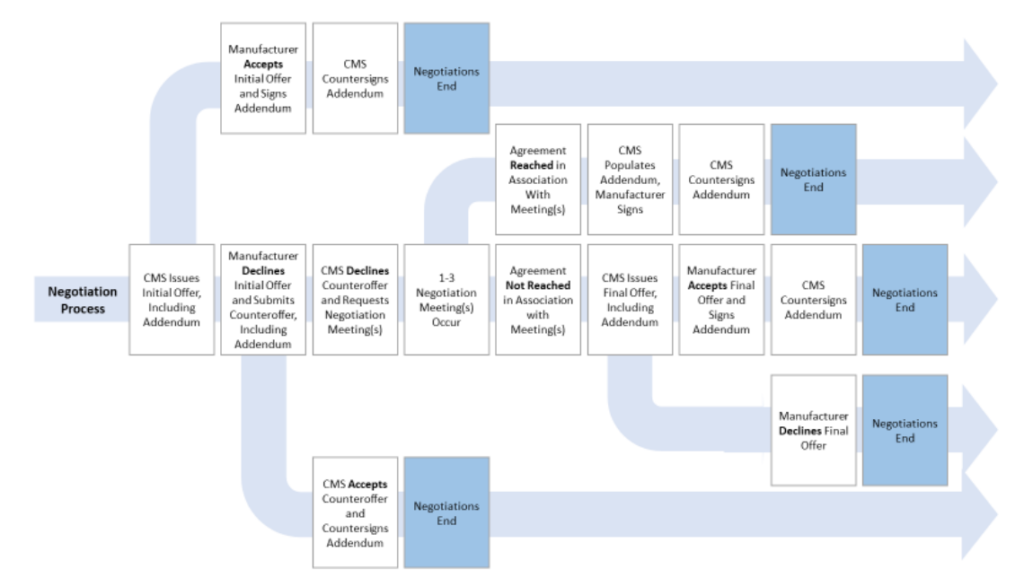

How will the negotiation process work?

This is summarized in the graphic below.

More detail can be found in the CMS guidance document here.