Business Class flights, upgrades to hotel suites, private lounge access at airports and chain hotels…these are all the domain of the wealthy and the frequent executive travelers, right? Not necessarily. You can join their lifestyle at any time if you tap into the right credit card perks for travelers.

Every once in a while I’ll be on a tour or staying at a hotel where I can’t help but hear the conversations around me. Sometimes I hear something that makes me stop what I’m doing and listen. Once I was on a trip to Peru where at the table next to me, one traveler asked, in amazement, “Why would you use a debit card to pay for an $8,000 tour? Are you out of your mind?!”

The recipient of this question mumbled something about responsible spending and not going into debt, but the others three at the table hit him with a barrage of arguments about why this was a dumb move. At the end it had him saying, “Okay, OKAY—I get it. So what travel card should I get?”

On the one hand, you’ve got to admire a guy who got to retirement age without putting things on a credit card. That restraint and fiscal responsibility are admirable. On the other hand, half the people at that table I was eavesdropping on had not paid for their flight—they cashed in frequent flyer miles to get to Peru. All of them were staying on an extra day or two for free also: they cashed in hotel points to spend extra time in Lima.

This guy, on the other hand, had laid out plenty of real money to get there and was flying home the day the tour was over. They all paid the same amount for the tour upon arrival, but they certainly did not pay the same amount for transportation or lodging. Plus the ones playing the credit card perks game got an extra 8K points at a minimum when they put the cost of the tour on the right card.

Travel Hacking Vs. Leaving Money on the Table

As it came out in the conversation I was eavesdropping on, there are those who exploit the opportunities to elevate their travel and those who don’t even know the opportunities exist. The former are showered with perks, the latter—responsible as they may be with their money—end up looking like suckers. “Do you have to pay to check a bag?” one asked. “Do you have Global Entry and TSA Pre-check paid for?” asked another. “Do you get a room upgrade when you check into a hotel?” a third chimed in.

The point they were making—and it wasn’t hard to make—was that getting the right credit cards can make your travel life a lot more pleasant. If you charge things and never pay any interest because you pay the card off each month, then you’re only out the annual fee. With some cards the annual fee pays for itself (or close to it) thanks to the anniversary bonuses they give you for sticking around.

Unless you never take a flight or stay at chain hotels after getting the card, it’s almost impossible that even a casual leisure traveler won’t come out ahead. Plus the travels will be more comfortable thanks to your elevated status.

The hotel and airline loyalty programs are a game. Those who play the game can win big and get showered with travel perks and the game is actually pretty hard to lose. The only people who really lose badly are the ones that don’t play at all. You can grab some of the money on the table or you can leave the cash sitting there.

Airline Credit Card Perks

If you fly a certain airline (or their alliance) a lot, it’s a no-brainer to get one of that airline’s credit cards. If there’s a juicy sign-up bonus being offered, then you could end up with a free international flight without even earning a single mile from flying. And these days, you don’t earn much by flying, so getting the right card will earn you more anyway just from putting bills and gas pump charges on the card.

If you get the Amex Gold Delta Skymiles card, for instance, with the offer as I write this you can get 50,000 miles after meeting the minimum spend in three months. I’ve seen more generous offers from them in the past, but that will often get you to South America and back if you’re flexible with your dates, or at the least pay for a trip to Mexico.

Perks include a domestic free bag check, priority boarding, tk. Spend $10K on it in one year and you’ll get a $200 flight credit too. I managed to do that in 2024 by putting a lot of bills on the card and halved the price of one of my tickets. See the details here.

You’ve got to pay this one off every month though. The interest rate starts at 20% and then rises further into loan shark territory.

The American Airlines card from Citi also has super-high interest rates starting at 20% and the same underwhelming 50K offer currently. As with Delta, their free checked bag perk only applies to domestic flights, so this one is better for US travel than international flights where there’s a bag fee, like ones to Mexico. (United’s card covers a bag on all flights though, so that’s a better one to get if you’re not near a hub for AA or Delta.)

The AA card has one huge advantage though if you fly American enough to get to elite status: points from credit card spending count as elite miles. So it’s a lot easier to buy your way to status and extra perks on AA than it is on the others. One big disadvantage for Latin America though: there is no other OneWorld alliance partner that will get you to Central or South America. Their only partner in the Americas left is Alaska Air.

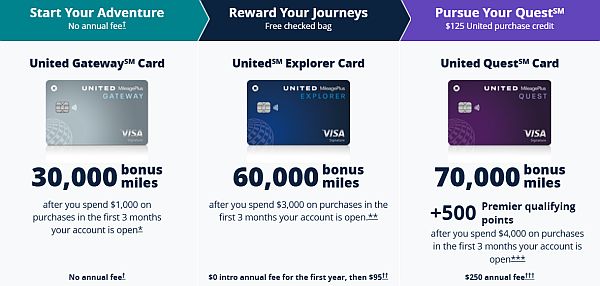

The United Airlines Explorer Card is my top pick for airline credit cards because it has the best perks by far. As mentioned above, you get a free checked bag on all flights, not just the ones within the USA. You can see the three choices below, with a higher annual fee getting more extras, but the Explorer one with a 60,000-point sign-up bonus has a $99 fee, which is lower than the two above but give you more points up front.

You can easily cover the annual fee with saved baggage fees plus there’s another huge advantage that the others don’t offer: the Chase United Explorer and Quest cards come with two free lounge passes per year. That alone almost cancels out the annual fee. Plus you don’t even pay the annual fee until the renewal date, not the first year. Last, United is part of the Star Alliance, which means you can earn or use points on Copa Airlines or Avianca.

They have another option I cut off in the photo above because you pay more than $500 a year just to add lounge access. There are other ways to get lounge access that won’t be so costly unless you are in one of their hubs every month and will really use it a lot.

While the bonus may not be as high at first glance, 40,000 points as I write this, you can also get a free flight to Central America or Mexico with the Southwest Chase card. In some ways these points are worth more too. Southwest has a very standardized redemption formula that’s just related to the cost of the flight, with no “dynamic pricing” points changes on high demand days and no blackout dates. So these points are much easier to cash in for free flights than with the other legacy carriers. Plus no bag fees ever.

There’s just one big downside with this Southwest card though, an odd one for an airline card: it charges foreign transaction fees. So you don’t want to use it outside of the USA because that’s just handing extra money for nothing to Chase.

They no longer give you free drink tickets on your card anniversary, but they do deposit a few thousand extra miles in your account, which offsets some of the annual fee. That annual fee is the lowest of the major airline cards too, at $69.

If you fly to Latin America multiple times per year on a specific airline, you may want to look into ones offered by a foreign carrier. The Avianca one has a reputation as being the most generous with its points, but you can also get ones from Aeromexico, Copa, or LATAM.

The Joy of Having a Hotel Branded Credit Card

While an economy seat on an airline might not get you very excited, how about automatic room upgrades and free hotel nights at a luxury property?

Not all hotel loyalty program cards are created equal because the programs aren’t as comparable as the airline ones. Some may have easy redemption at 15,000 points, while on others that might not even get you into a motel. I have cards from Hilton and IHG personally. The first I got because the sign-up bonus was huge and I ended up getting three nights on three occasions just from the sign-up bonus.

The Hilton card offer varies, but right now it’s a whopping 165,000 points for their Surpass card with a $150 annual fee. I use this one and the IHG one below frequently, scoring 16 free nights between the two of them last year. With so many points awarded to you up front and the ease of building up more through their spending multipliers, you could easily cash in for a couple of nights at the Conrad Punta de Mita or Waldorf-Astoria Panama City.

Book this resort with Hilton loyalty points earned with credit card spending

You get Gold status automatically when you have this card too, which can lead to travel perks like room upgrades, free breakfast, or executive lounge access.

I am a big fan of the IHG Rewards card from Chase. I’ve had it for more than a decade now. I don’t love it because their hotels overall are all that luxurious—though they do now have Kimpton and Six Senses in the mix—but because the point cash-in levels are quite reasonable. You can often get into an Intercontinental or Crowne Plaza for a point total that’s often half what you see for a comparable property at Marriott.

Plus every year upon renewal they give you a free night for any hotel up to 40K points, which is great to cash in when you need an airport hotel or a road trip stop and don’t feel like laying out the money for that. I’ve cashed in points with them in Mexico, Nicaragua, Costa Rica, Chile, Argentina, and Colombia just in Latin America, more in Europe and the USA.

As I write this, if you get the IHG Rewards One Premier card that I have, you get four free nights at properties valued at 40K points or less after meeting the minimum spend. I can tell you from experience that most of the Intercontinental properties in Latin America will come in under that maximum if it’s not a holiday weekend and now there is a Kimpton in Mexico City and one in Roatan, Honduras that we’re hoping to check out soon.

This IHG credit card gives you Platinum Elite status, which means you’ll usually get upgraded to a better room and sometimes you get perks like lounge access, snacks, or a partial points rebate.

There are other hotel card options of course if you prefer a different chain. The Hyatt one is quite good in terms of what you get from the bonus and spending, the Marriott one not so much because of very high (and complicated) redemption levels. The simplest one is via Barclays for Wyndham Rewards, which only has three redemption levels, but they don’t have many luxury properties in Latin America.

Travel Credit Cards With Convertible Points

There’s also an advantage to having an Amex card with Membership Rewards or, maybe even better, a Chase Sapphire Rewards card. With those you’ll pay more, but you can transfer your miles to multiple programs, giving you the ability to “top off” your account to get to an award tier you need for a trip.

The highest level of those cards also get you lots of perks like reimbursement for Global Entry, reimbursement for bag fees, Priority Pass membership, and in the case of Amex, access to their own Centurion lounges.

If you only fly business class or above, that’s okay. Use these points to top off your total and you’ll have enough to upgrade or bring a spouse. Plus you’ll earn huge bonuses when you charge flights to these cards. Even if you don’t have status on a particular airline, you’ll get some credit card perks that save you money or speed up your journey.

There’s a third option for this you don’t hear as much about. Capital One has a premium card that allows transfers to different programs, plus they including Priority Pass lounge access for you and a couple of other people. This is the next one I’m going to add to my wallet because I’ve got a couple of really long layovers coming up this year.

Which Credit Card Perks Are Right for You?

Which card should you get for the best travel perks?

Well if that man at the table next to me in Peru had posed the question, I wouldn’t have answered right away. I would have asked him where he lives, what airline he flies the most, and what kind of hotels he stays in. As I noted in this earlier post, you may have access to different hotel brands than the most obvious with some of these hotel cards. But a card for an airline you never fly isn’t of much use.

I would also tell him, however, to forget getting just one. Ideally, you should at least have one airline card, one hotel card, and one credit card that allows you to move points to different accounts as needed. This way you’ve got the best chance of getting all the credit card perks available.

Sure, that’s going to cost you a few hundred bucks a year come renewal time, but you’ll easily earn that back from all the extra goodies you receive.

If keeping track of three cards makes your brain hurt, then just get the Chase Sapphire Preferred card so you can transfer points to different accounts. You also get a rebate when you book travel with them, plus you earn points more quickly with them than with Amex: 5X on purchases through Chase Travel, 3X on dining, 2X on other travel purchases.

Then instead of spending $8,000 on a debit card that doesn’t do anything for you, instead you could be getting comped flights, free hotel rooms, and perks that the regular customers never see. Just float that spending for a month and the travel hacking rewards can be huge, even for luxury travelers.

Get on our insiders list and receive our monthly updates. Join us here and you’ll get a free report on how to get a hotel upgrade more often when you travel.

Disclosure: Luxury Latin America is free to read because it is reader-supported through advertising. Some links in this post may provide us some compensation in the form of small commissions or loyalty points. They will never cost you more than if you went to the site directly.