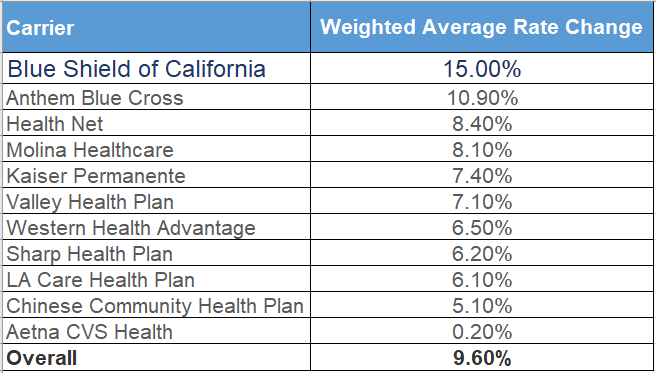

The 15 percent increase in the individual health insurance premium by Blue Shield causes many Californian families to worry about how they can find affordable health insurance in 2024 for their families.

The healthcare landscape in the United States is complex, with numerous factors influencing insurance premiums. Similar to other insurers, Blue Shield of California encounters challenges. These include escalating medical expenses, advancements in medical technology, and higher wages in the medical sector. and the growing prevalence of chronic conditions. These factors collectively contribute to the rising costs of providing health coverage.

Source: Covered CA, read full article here

Several interconnected factors contribute to the escalation of insurance premiums within the healthcare industry. First and foremost, medical inflation emerges as a significant contributor as healthcare expenses continuously grow. These expenses encompass hospital stays, prescription drugs, and medical procedures, directly impacting insurers’ costs. Simultaneously, advancements in medical technology are occurring alongside improvements in treatment. However, this progress comes at a high cost, compelling insurers to adjust prices. Furthermore, there are higher labor costs in the medical sector. Consequently, insurers are forced to adapt to the changing medical landscape, resulting in increased healthcare costs and subsequently higher premiums.

The shifting demographics of the population play a pivotal role in the dynamics of the healthcare landscape. An aging demographic, coupled with an uptick in chronic diseases, has led to an elevated demand for healthcare services. Consequently, demographic changes place additional strain on insurers as they endeavor to adapt to the evolving needs of policyholders. This, in turn, significantly influences adjustments in premiums as insurers navigate the complexities of healthcare demands in an ever-changing demographic landscape.

Why choose Blue Shield?

In California, Blue Shield in the individual insurance market provides a HMO and a PPO. The HMO Trio Plan is notable for its strong primary care doctor network, prominently featuring the Providence System. Within this comprehensive network, significant medical institutions, including St. John Hospital, St. Joseph, Providence Cedars Tarzana, Access Medical Group, and Allied Pacific-UCLA, are included.

The Blue Shield PPO plan features an extensive network, allowing policyholders self-access to numerous distinguished doctors affiliated with institutions such as UCLA, Cedars Sinai, and Providence. This dual offering accommodates diverse preferences and healthcare needs, providing individuals with the flexibility to choose a plan that aligns with their specific requirements. Additionally, it ensures access to a broad spectrum of healthcare professionals.

At Solid Health Insurance, we ease the complexity of the individual insurance market. We find a health plan that fits your budget and your medical needs. You may call us at 310-909-6135 or book an appointment. We’d be happy to answer your questions about your health insurance for individuals, families, and small businesses.