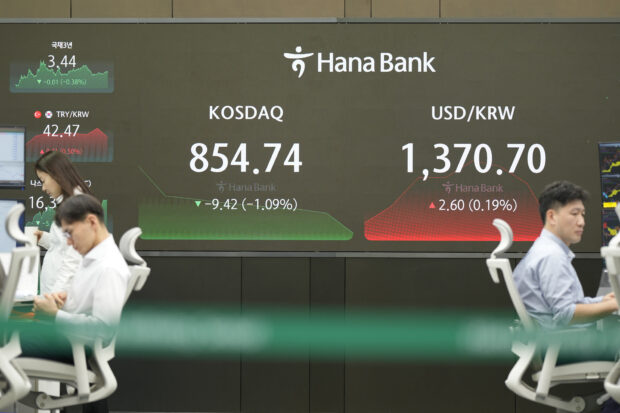

Currency traders watch computer monitors near the screen showing the Korean Securities Dealers Automated Quotations (KOSDAQ) and the foreign exchange rate between U.S. dollar and South Korean won at a foreign exchange dealing room in Seoul, South Korea, Monday, May 13, 2024. Asian stocks were mostly lower on Monday after Wall Street coasted to the close of another winning week.(AP Photo/Lee Jin-man)

HONG KONG — World stocks were mixed on Monday after Wall Street coasted to the close of another winning week.

European markets were little changed. Britain’s FTSE 100 rose 0.1 percent to 8,444.23. Germany’s DAX edged down by 2.40 to 18,770.45 and the CAC 40 in Paris lost 0.1 percent to 8,210.88.

The future for the S&P 500 edged 0.1 percent higher and that for the Dow Jones Industrial Average was less than 0.1 percent higher.

In Asia, the release of weak Chinese lending data and news that the U.S. government plans to raise tariffs on a raft of Chinese exports were weighing on sentiment.

Japan’s benchmark Nikkei 225 shed 0.1 percent to 38,179.46. The country’s first quarter economic growth figures are due to be released on Thursday.

Hong Kong’s Hang Seng rose 0.8 percent and ended at 19,108.78, helped by the buying of technology shares.

But the Shanghai Composite index was 0.2 percent lower, to 3,148.02, after China’s inflation data rose for a third straight month in April, while the producer price index, which measures the cost of factory goods, declined for a 19th month, the National Bureau of Statistics reported on Saturday.

READ: Asian markets mixed as traders pause ahead of US inflation data

New loans fell to 730 billion yuan ($100 billion) in April from 3.09 trillion yuan in March and total credit declined partly due to a lower level of government bonds being issued. Officials said the data show demand remains weak with the real estate sector still ailing.

Tariffs on electric vehicles

The Biden administration is expected to announce this week that it will raise tariffs on electric vehicles, semiconductors, solar equipment, and medical supplies imported from China, according to people familiar with the plan. Tariffs on electric vehicles, in particular, could quadruple from 25 percent to 100 percent.

READ: US aims to ensure local EV maker success as China boosts exports

These tariffs, which are expected to be announced on Tuesday, sparked selling of some automakers. Chinese EV maker BYD’s stock dropped 0.2 percent and NIO slumped 2 percent.

South Korea’s Kospi fell less than 0.1 percent to 2,727.21 and Australia’s S&P/ASX 200 was 1 point higher to 7,750.00.

Taiwan’s Taiex gained 0.7 percent after leading computer maker TSMC reported its revenue surged nearly 60 percent in April from a year earlier. India’s Sensex fell 0.6 percent.

On Friday, the S&P 500 rose 0.2 percent to 5,222.68 to finish a third straight winning week following a mostly miserable April. Early gains shrank after a discouraging report on U.S. consumer sentiment.

The Dow Jones Industrial Average gained 0.3 percent to 39,512.84, and the Nasdaq composite edged down by 5.40 to 16,340.87.

The S&P 500 is within 0.6 percent of its record, helped by revived hopes the Federal Reserve may cut interest rates this year. A flood of stronger-than-expected reports on profits from big U.S. companies has also helped support the market.

Weakening consumer sentiment

In the bond market, Treasury yields rose following the discouraging preliminary report from the University of Michigan.

It suggested sentiment among U.S. consumers is weakening by much more than economists expected, and the drop was large enough to be “statistically significant and brings sentiment to its lowest reading in about six months,” according to Joanne Hsu, director of the survey of consumers.

READ: US consumer confidence ebbs in Feb; inflation expectations fall

Potentially even more discouraging is that U.S. consumers were forecasting inflation of 3.5 percent in the upcoming year, up from their forecast of 3.2 percent a month earlier. If such expectations spiral higher, the fear is that it could lead to a vicious cycle that worsens inflation.

In other trading, benchmark U.S. crude rose 33 cents to $78.59 a barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the international standard, was 27 cents higher at $83.06 a barrel.

The U.S. dollar edged up to 155.88 Japanese yen from 155.70 yen. The euro cost $1.0777, up from $1.0771.