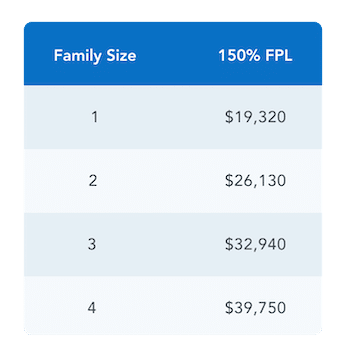

There is a new Special Enrollment Period (SEP) that enables qualifying consumers to enroll into a Marketplace coverage for the remainder of the 2022 calendar year. To qualify, the total household income must fall at or below 150% of the Federal Poverty Line. Eligibility is based on the previous year’s FPL chart. See chart below for reference.

Through this SEP, anyone who fit this eligibility can enroll in a Marketplace plan and those already enrolled in a plan can change their plan. If you are already enrolled in a plan and choose to change your plan, your deductible and out-of-pocket max will reset.

Who is eligible for this SEP?

Usually, consumers can apply for a plan at two times of the year:

- During the annual Open Enrollment Period, generally 11/1 – 1/15

- During the Special Enrollment Period, 1/16 – 10/31, where consumers typically need a Qualifying Life Event such as losing their employer coverage, having a child, or moving in order to enroll in a Marketplace plan.

During this Special Enrollment Period, you may be eligible if you fall in both of these criteria:

- Have an estimated annual household income at or below 150% FPL

- Are eligible for Advanced Premium Tax Credits (APTC)* which are a subsidy applied to your monthly premium

*As a reminder: Consumers with income below 100% FPL but who do not qualify for Medicaid due to immigration status only may still be eligible for APTC if they meet all other Marketplace eligibility requirements. They would also qualify to use this SEP.

Who is not eligible for this SEP?

Consumers must be eligible for APTC (a subsidy applied to your monthly premium) in order to use this SEP. That means they cannot be eligible for Medicaid or offered affordable employer-sponsored coverage. This also means consumers who fall into the Medicaid Gap (i.e. make less than 100% FPL in states that did not participate in Medicaid expansion) cannot use this SEP; nothing about this new SEP changes their eligibility for subsidies.

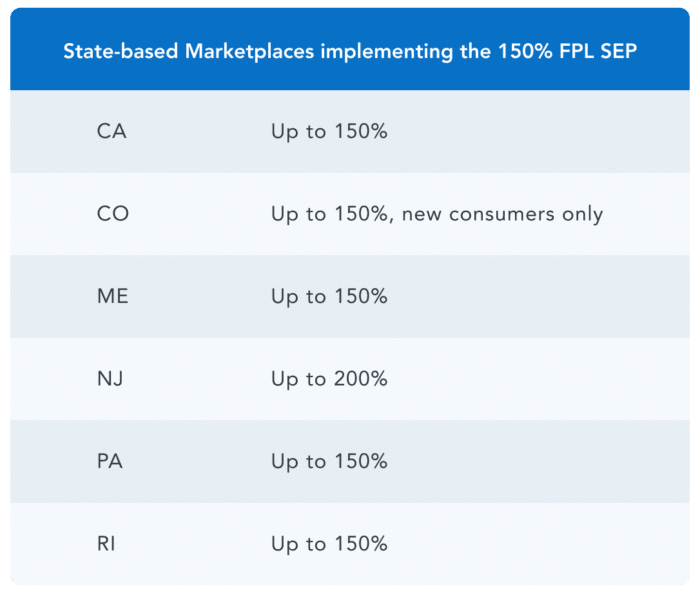

This SEP is live for the Federally-facilitated Marketplace (FFM) and all plans on HealthSherpa. Implementation of this SEP varies for states that operate their own exchange.

What are the effective date rules?

This monthly SEP will follow accelerated effective date rules, which means consumers can enroll any day of the month and have their coverage start the first day of the next month. For example, if a consumer enrolls in a plan on 3/30/22, their coverage will begin on 4/1/22.

How will I know if I have received this SEP?

After submitting an application, any qualifying applicant of this SEP will see that they have received the SEP “due to estimated household income (≤150% FPL)” on the eligibility results page.

How long will this SEP last?

For now, this SEP only exists for the 2022 calendar year. It will only be extended if the American Rescue Plan (ARP) subsidies are extended. With ARP subsidies, most consumers who are eligible for this SEP can enroll in free silver plans.

How do I know if I qualify for this SEP?

To see if you qualify, you can start a quote by entering in your zip code below.