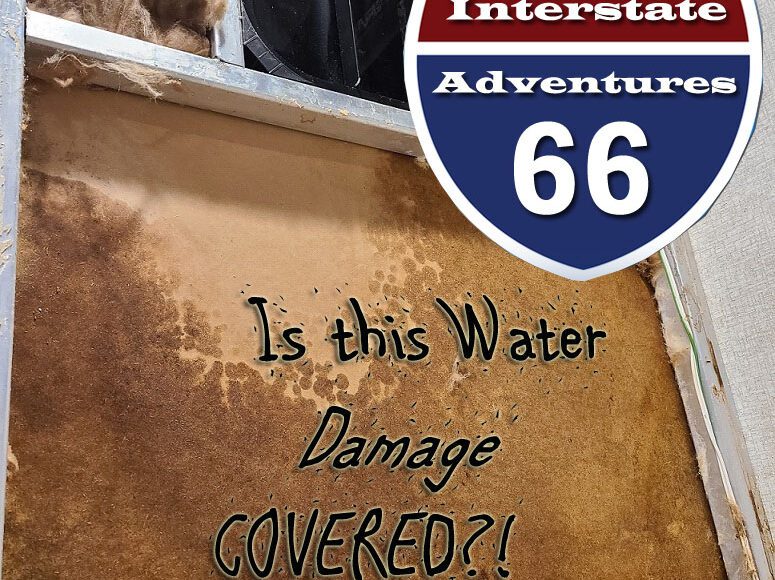

Is this Water Damage on our Living Room Slide Covered?

Is this Water Damage on our Living Room Slide Covered?

RV Water Damage is a scary thought, especially if you are full time in your RV like we are. After watching the news about Hurricane’s crippling Florida it got us thinking about Water Damage.

Hurricane Sandy took our home in New Jersey back in 2012. We also had friends and family in Florida that suffered severe water damage from Hurricane Ian. We know first hand the destruction a Hurricane can produce.

But not all water damage is from Hurricane’s. Sometimes it’s a broken Hot Water Heater, or a burst pipe. What about a leaky roof? Fittings come loose all the time while you are driving down the road.

Or even a human error like connecting your fresh water line to the black tank flush! So we called our insurance agent and asked a lot of questions. Questions that we probably should have asked before we started this adventure. Now we’d like to share that information with you.

Comprehensive Coverage

Under your insurance policy is a subheading called Comprehensive. The comprehensive portion of your policy is what covers the cost of repairs and replacement for damage from a non-collision incident. So, this is where coverage comes from for hurricane’s. Because it isn’t a collision, but is an incident, your insurance company should cover it. This will include any water damage caused by said hurricane.

Other examples of things covered under this portion of your policy are theft, or vandalism. But we’re focusing on water damage. If there is an non-collision incident that has caused your water damage, it will be covered under the comprehensive portion of your policy. If a deer decides to have a fight with your camper and stabs his antler into your hot water heater, it would covered here.

Collision Coverage

Unlike the Comprehensive coverage, this is specific to collision incidents. Obviously, accidents happen. Unfortunately, we see them on the road all too often. Having collision coverage is required if your RV is financed. But it’s also where the money will come from for any repairs that needed from an accident. At the same time, there are some collision incidents that would cover water damage on your RV.

If you damaged a slide when you accidently hit a tree backing into your site, water could potentially start coming in through the seals. Because this incident happened while you were driving and a collision occurred, this should be covered by your collision policy.

RV Water Damage From Other Issues

Alright, so we’ve covered comprehensive and collision water damage. But what about when the water damage is from a burst pipe? How about if your roof starts leaking? Our insurance representative told us NO. These are not things that are covered. We have a Full Time RV Policy with Progressive Insurance. When you own a home, you can purchase Flood Insurance to cover these items. But when we asked if we could purchase Flood Insurance for our RV, we were also told No. Even though it’s our home.

Here’s the thing… Purchasing flood insurance for a home is easier. The insurance company brings up the FEMA map for flood risk in your area and quotes you a price. However, your RV is mobile. Because the insurance company can’t determine the risk factor they won’t write you a policy. You could literally bring your RV anywhere. Even though a burst pipe would be covered under a Flood Insurance policy, it covers more than just burst pipes.

What Can You Do?

To our knowledge, there is nothing you are going to be able to do to have these types of water damage covered by your insurance carrier. If your RV is still under any kind of warranty, and the damage is due to a defect, it may be covered there. Unfortunately, our human error situations, like connecting your fresh water to the wrong place, isn’t covered. However, you should check out my article on Warranty vs Insurance because even your warranty coverage may deny it.

The bottom line is you need to do everything possible in the preventative maintenance department. You should have a heated hose or heat tape connected to your spigot. Or disconnect your hose on cold nights. Flush your hot water heater regularly. Clean your refrigerator periodically to prevent ice build up. Check and maintain your roof religiously. All of these things are important. Especially if your rig is a little older. Water damage is a bitch. Doing risk mitigation will save you money for those non-covered emergencies.

Write to us and please let us know if you have had any experience with these issues being covered by your insurance carrier.