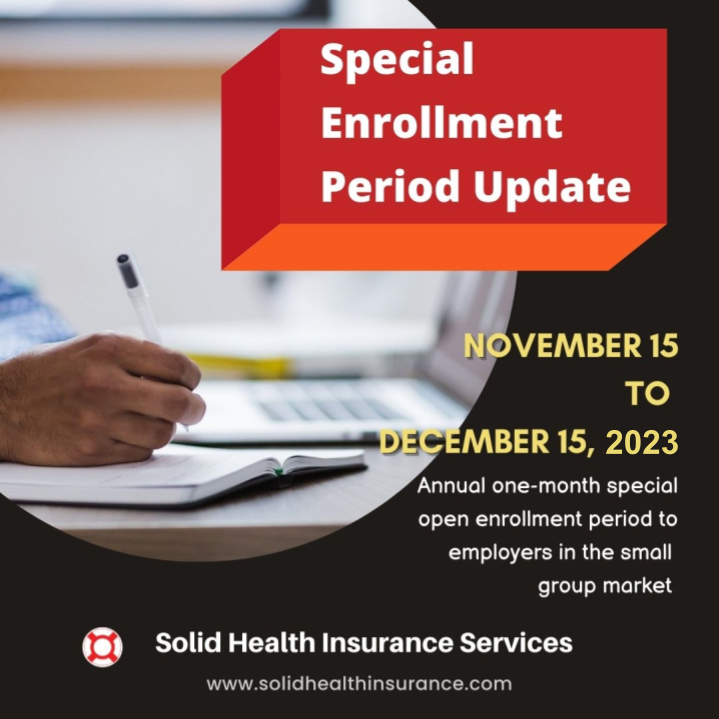

Every year, small businesses have a special window to start a small group health insurance policy with small group health insurance carriers with relaxed underwriting. This period is known as a Special Enrollment Period and starts on November 15th through December 15th. During this period, small businesses can sign up for small group health insurance coverage with no minimum employee participation rate (usually 65-70% employee participation required) and no minimum employer contribution to the health plans (usually $100 or 50%).

During this one-month period, small businesses can seamlessly provide group benefits without concerns about meeting employee participation quotas or calculating contributions toward employee benefits. Numerous insurance carriers, including Anthem Blue Cross, Blue Shield of California, and Cigna + Oscar, will exempt the requirement for submitting a De9C (quarterly payroll report) as long as at least three employees enroll or participate in the group benefits. Kaiser, SHOP Covered CA, and California Choice also offer highly adaptable underwriting processes to encourage more small businesses to extend benefits to their employees.

Group insurance benefits play a pivotal role in an employee benefits package, offering a competitive edge in the job market by attracting top talent and retaining current employees. They not only enhance your organization’s appeal but also provide a reliable, cost-effective solution for employers, offering stable costs through negotiated premiums with insurance providers in advance, unlike self-insured or individual insurance plans. Moreover, healthy and financially secure employees are generally more productive and engaged.

If your small business is considering offering employees group benefits, now is the perfect time to review your options. Read this blog to learn the basics.

At Solid Health Insurance Services, we take great pleasure in guiding you through the array of plan choices for your employees. We’re excited to offer you complimentary online onboarding for your employees and seamless online benefits processing for health, dental, vision, life, and disability coverage. Feel free to reach out to us at ☎️310-909-6135 or email us at barb@solidhealthinsurance.com or schedule a quick meeting for more information. Our commitment is to help you and your company find the right benefit plans that take care of your employees’ health needs while also meeting your financial goals.